VA Loan Rates

Current VA Loan Rates

| Rate Type | Rate | APR |

|---|---|---|

| 30 Year Fixed | ||

| 3/1 ARM | ||

| 5/1 ARM | 3.25% | 3.467 |

VA Loan Rates

The VA offers several mortgage types, and each carries its own va loan interest rate, fees, and closing costs. The details can feel daunting, but you don’t have to master them because our VA Loan Specialists already have. Let them help you choose the right type of loan for your individual situation. They’ll also help you lock in the best interest rate possible.

Factors Affecting Your Interest Rate

Your interest rate can be affected by several factors, including:

- Your credit score

- Debt-to-income ratio

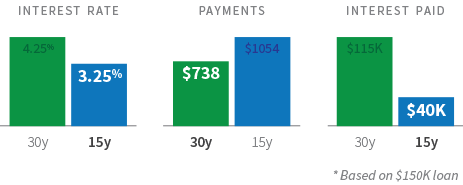

- Duration of loan (15-year, 30-year, etc.)

Fixed-Rate VA Loans Rates

The interest rate on a fixed-rate mortgage never changes during the life of the loan.

- You can choose a fixed-rate loan with payments over 30 years, 25 years, 20 years, or 15 years.

- Typically, the shorter the loan life, the lower the interest rate.

- A loan specialist can help you sort through the pros and cons of each option.

Hybrid ARM Loan Rates

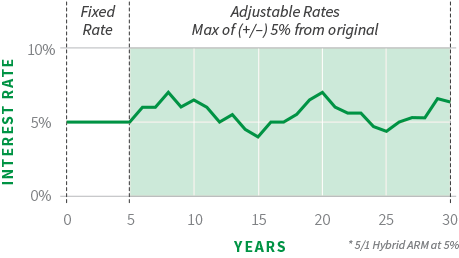

Hybrid loans are a mixture of fixed and adjustable rates.

- Lowest interest rates available.

- The loan rate on a VA hybrid ARM is fixed for either 3 years or 5 years and then becomes adjustable.

- After the three or five-year fixed period, the interest rate can go up or down.

- Never more that 1% per year and 5% over the entire life of the loan.

- The initial fixed period carries a lower interest rate, making it easier for first-time buyers to become homeowners.

VA Streamline Refinance Loan Rates

If you already have a VA home loan and want lower monthly payments, consider a VA Streamline Refinance.

- Our loan specialists can help calculate how much you will save by refinancing.

- Paperwork is “streamlined,” making your refinance faster and easier.

VA Cash-Out Loan Rates

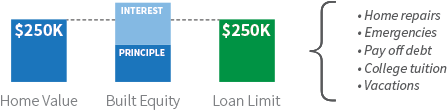

If you want to refinance a VA loan while at the same time taking cash out from the value of your home, consider a VA Cash-Out Loan.

- Borrow up to 100% of your homes’ value

- Turn your equity into cash for home improvements, debts, or simply extra cash.

- Our loan specialists will explain interest rates, fees, and how much equity you can safely withdraw.

VA vs. Conventional

VA home loans have many advantages over conventional loans.

- Lower interest rates.

- No downpayment required (in most cases).

- No Private Mortgage Insurance (PMI).

- Fewer allowable fees

Why choose VA Loan Desk?

A division of Belem Servicing LLC DBA PAtriot Home Mortgage-

Our Experience

Patriot Home Mortgage and VA Loan Desk finances more homes for veterans than any other VA lender in the United States.

-

Our Expertise

Years of experience gives us unmatched expertise that ensures you get the most from your VA benefits.

-

Our Network

VA Loan Desk’s vast network of lenders throughout the U.S guarantees you the lowest possible VA loan rate.

Call to talk with a VA Loan Specialist.